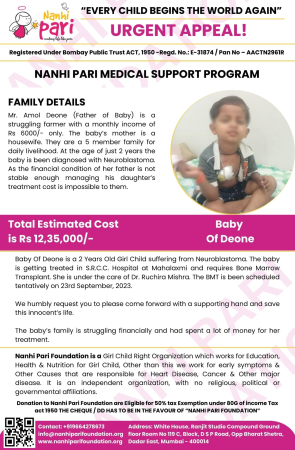

Baby of Deone

Donations to NANHI PARI FOUNDATION are eligible for 50% tax Exemption under Sec 80-G Income tax Act 1956

Age : 2 year old Child

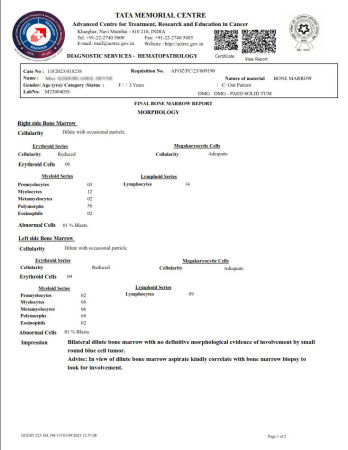

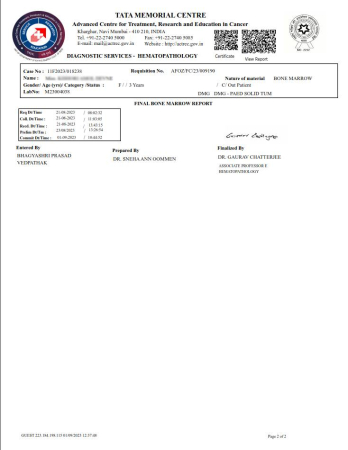

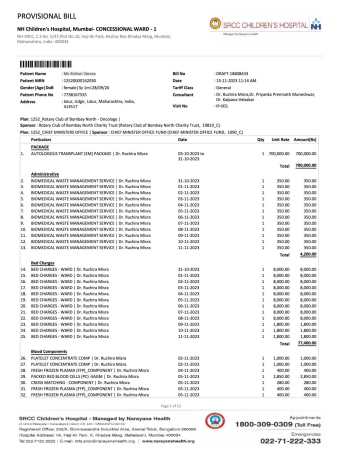

Cause : Neuroblastoma and Needs Autologous Bone Marrow Transplant

Help 2 Years Old Baby To Undergo Bone Marrow Transplant!

Baby is just 2 years old girl child and is from Borol, Latur, Maharashtra.

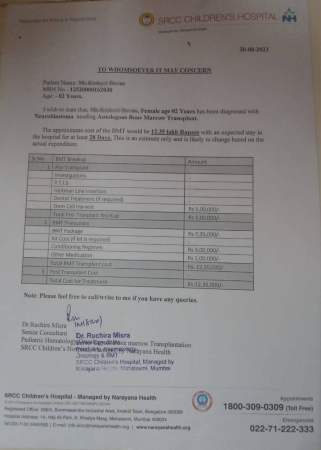

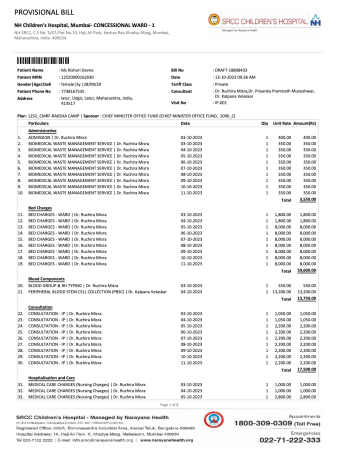

She has been diagnosed with Neuroblastoma. The only curative treatment for her condition is Bone Marrow Transplant. She has been planned for it at S.R.C.C. Hospital, Mahalaxmi and

approximate cost is Rs 12,35,000/-.

As per her treating doctor, she requires the transplant to be done at the earliest as possible so her BMT is been scheduled on 23rd September, 2023. Her lifelong chances of being free from cancer is high if the BMT is done on time.

Her father is a struggling farmer with an income of Rs 6,000/- only. He have already spent enough for her treatment and now his only hope is left with donors like you.

Family has reached out to Nanhi Pari Foundation seeking help. After meeting them and going through their situation, our NGO has taken up their cause on Humanitarian grounds and created this fundraising link for family so as to generate help from support of donors..!

Please help us raise this amount by clicking on the donate button and sharing this page with your friends and family. We are grateful for your help and wishes.

While donating through Nanhi Pari Foundation you are eligible to claim tax exemption under section 80G of Income Tax Act, 1961.

All Offline / Online Donations are Tax deductible under section 80G.

THE CHEQUE/DD HAS TO BE IN THE FAVOUR OF “NANHI PARI FOUNDATION”

TEL: +91 9664278673

Email – info@nanhiparifoundation.org

Web: www.nanhiparifoundation.org

Office Address – Office No 101, First Floor, M Block, Ranjit Studio Compound, Dadasaheb Phalke Road, Dadar East. Mumbai 400014

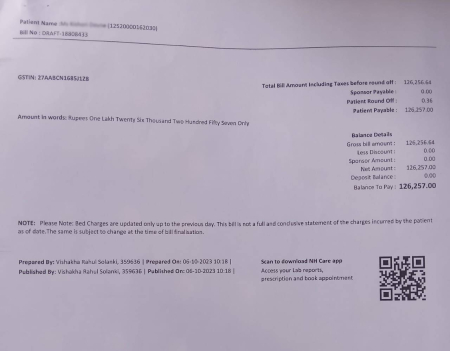

Update 16/11/2023

Dear Supporters,

Thank you all for your immense love and support! Hope you all are doing well.

Wanted to share a quick update on my daughter, Baby Kishori Deone. Her Stem Cells Transplant is been successfully done. She continues to be in the hospital as she got caught with dengue and her platelet counts have reduced drastically. She will require a prolonged hospital stay. I will keep you all posted about her health condition here, request you to keep her in your prayers.

The hospital bill is increasing daily and I have no financial source left. We are having shortage of Rs 95,000 from our committed amount and need your assistance to raise enough funds for this baby girl’s treatment.

Thanks and Regards,

Team Nanhi Pari Foundation

Mr. Amol Deone (Father of the baby)

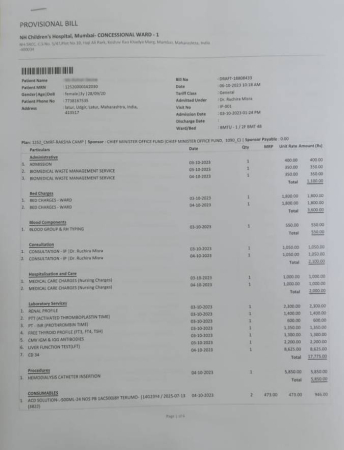

Update 16/10/2023

Dear Supporters,

Thank you all for your immense love and support! Hope you all are doing well.

Wanted to share a quick update on my daughter, Baby Kishori Deone. Her Stem Cells Transplant is been successfully completed. She continues to be in the hospital and her treatment and medication are going on. She is a bit stable now and will require more 1 month of hospital stay. I will keep you all posted about her health condition here, request you to keep her in your prayers.

The hospital bill is increasing daily and I have no financial source left. We need your assistance to raise enough funds for my daughter’s treatment.

Thanks and Regards,

Team Nanhi Pari Foundation

Mr. Amol Deone (Father of the baby)

6/10/23

Dear Supporters,

This is to inform you that Baby has been hospitalized for her Stem Cells Transplant.

Baby is under-going with the Transplant treatment and in medical observation.

She is in need of your prayers and support.

Parents have already done with all they can but they are still short of approx. Rs 1 lac from the total bill amount so we request you to please come forward and support the maximum possible from your end.

Please have this campaign link shared with your family and friends.

We will keep you all posted about the baby’s health condition!

Thanks and Regards

Nanhi Pari Foundation

Donate via Paytm/Google Pay/PhonePe

In case you have donated directly through UPI, kindly WhatsApp your details such as Name, Address and PAN for 80G receipt on

+91-9664278673

DONATE FOR A CAUSE!

Baby of Deone

Recent Donors

Trilochan Panda

April 15, 2024

Sujoy Bhattacharjee

November 27, 2023

Surinder Uppal

November 20, 2023

Sajjid Z Chinoy

November 5, 2023

Viraj Khedekar

November 3, 2023